Why and How Much Tax a Blogger Should Pay in Pakistan?

Posted by AAMIR ATTAA

Bloggers’ community and those who earn their money through online resources, ever you thought that the money you earn is taxable? It’s little hard to digest, but yes, the money we earn through our blogs, forums, online portals and through any other online resource is taxable.

In this post I will try to explore on why and how much should we (online community) should pay taxes?

As per Federal Bauru of Revenues, following categories of individuals/entities should pay taxes,

- Companies

- Association of Persons (AOP)

- Non Salaried Individuals

- Salaried individuals

Bloggers and those who earn their money through online resources come under the category of “Non-Salaried Individuals”, or otherwise also called “Sole Proprietors”.

Why Should Bloggers Pay Tax?

If you have a look at Income Tax ordinance, 2001 (can be downloaded from here PDF File, 2.36 MB), it clearly narrates following cases where tax should be paid,

- The profits and gains of any business carried on by a person at any time in the year;

- Any income derived by any trade, professional or similar association from the sale of goods or provision of services to its members;

- Any income from the hire or lease of tangible movable property;

- The fair market value of any benefit or perquisite, whether convertible into money or not, derived by a person in the course of, or by virtue of,

With above mentioned points, taken from a legislation prove that any income we earn through blogs or otherwise through any resource should be taxed.

As a Pakistani citizen, it’s our responsibility to abide by the regulations and be responsible towards the act and the federation.

How Much Tax a Blogger Should Pay?

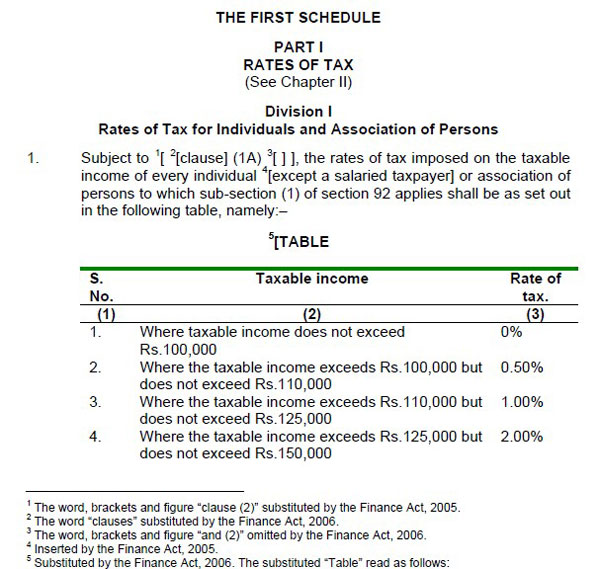

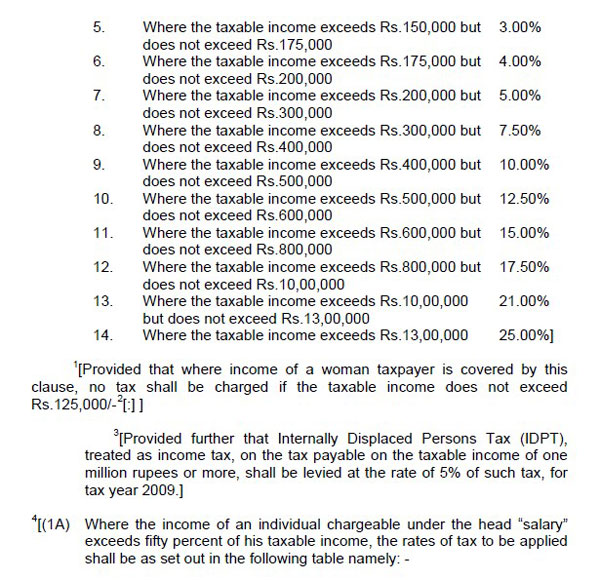

The amount of tax for each individual is dependent on his/her earnings. There are slabs defined by the FBR (which gets revised each year), to determine the amount of tax an individual or entity should pay. As we discussed above, that bloggers come under “Non Salaried Persons”, please read following chart to find out your tax per your annual income.

What is Taxable?

In simple words,

Taxable amount = All your Revenues – Operating Expenses (Hosting, advertising, editorial etc).

Meaning that if you earn Rs. 10,000 a month, it makes you earn Rs. 120,000 a year. This is your revenue, now exclude your expanses, for instance hosting costs you 10,000 a year, so your income will be = Rs. 110,000

You may exclude any other expanses (if any) from the revenues.

In this example, Rs. 110,000 is taxable – and as per table given above, 1 percent tax is applicable on this amount, meaning that Rs. 1,100 is the amount that you should pay to Government of Pakistan from your earning as tax.

What to Do?

Information provided in this post is just for reference, and cannot be taken as ultimate resource to measure taxes on your earnings. It is advised to consult an accountant, to find out the exact amount of tax payable. As mentioned above, tax rates keep on changing every year.

An accountant (an individual – maybe your cousin or friend of a cousin who did CA, ACCA, M.Com or similar education) or any accountancy firm to find out what rules to follow to calculate the tax and then ultimately paying it.

By the way, paying tax in Pakistan is not easy, I will narrate my experience of paying tax (sort of adventurous tale) in another post. Even getting an NTN (National Tax Number, or the basic key to pay tax) can be a tough job to do for a common person.

So be patient, while you are serving your country.

Note: Government of Pakistan has given tax exemption on the income from export of computer software or IT Services or IT Enabled Services up to the period ending on 30th June, 2016. According to the Income Tax Ordinance, 2nd Schedule clause 133:

Income from export of computer software and its related services developed in Pakistan: Provided that the exemption under this clause shall not be available after the 30th day of June, 2016.

Explanation: – For the purpose of this clause

A- “IT Services” include software development, software maintenance, system integration, web design, web development, web hosting, and network design, and

B- “IT enabled Services” include inbound or outbound call center, medical transcription, remote monitoring, graphics design, accounting services, HR services, telemedicine centers, data entry operations [locally produced television programs and insurance claims processing]

The post Why and How Much Tax a Blogger Should Pay in Pakistan? appeared first on .