Mobilink Posts Flat Q1 2015

Posted by AAMIR ATTAA

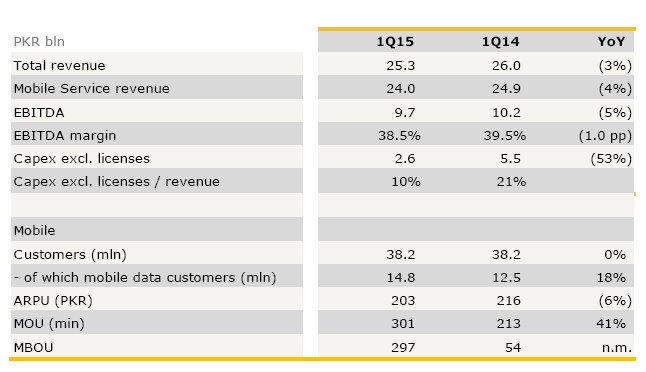

Mobilink’s revenues stood at Rs. 25.3 billion during first quarter of 2015, slightly down from Rs. 26 billion it generated during the same period last year.

VimpelCom, the parent group of Mobilink, said that revenues were hampered by SIM-reverification drive, lower VAS revenues because of simplified charging regime and increased price competition. Group said that SIM verification process had and will continue to have a negative effect on revenue for the rest of the year.

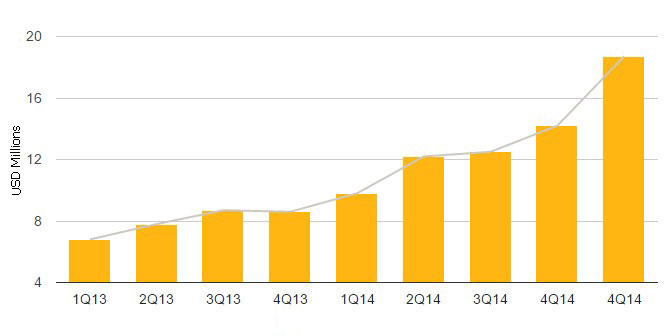

Mobilink’s data revenues, however, increased 88% YoY and reached Rs. 1.9 billion during the reported quarter.

Mobilink Data Revenues

Revenue from mobile financial services also doubled, thanks to increased focus, retail promotions and better reach throughout the country.

Capex decreased 53 percent to PKR 2.6 billion after the 3G network upgrade was completed in 2014.

Cost efficiency initiatives launched by Mobilink have driven underlying EBITDA margin, excluding re-verification costs, to 41.5%, while reported EBITDA margin was 38.5%, said the group financial report.

Mobilink’s ARPU stood at Rs. 203, down from Rs. 214 it had during same quarter last year.

Average minute usage per user per month reached 301, up from 213 minutes per user per month during the same period last year.

The customer base was flat YoY and decreased 1% QoQ, due to restriction in sales through retail channels and blocking of unverified SIMs as a result of the SIM re-verification.

Mobilink said that improving customer perception is its main priority. The Company continues to focus on price simplicity and transparency and improvements in network quality perception, the release said.

Below are key indicators for Mobilink’s Q1 2015 financials:

The post Mobilink Posts Flat Q1 2015 appeared first on .