FDI Posts 48 Percent Decline This Fiscal Year

Posted by SYED ZARAR

State Bank of Pakistan (SBP) on Tuesday revealed that the Foreign Direct Investment (FDI) has posted a 48 percent decline in the first four months (July to October) of the ongoing fiscal year 2016-17.

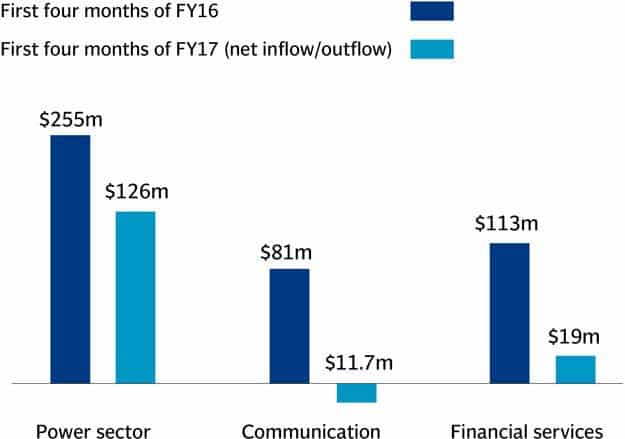

FDI fetched in July-October of FY17 amounted to $316.1 million, compared to $610.5 million in the corresponding period of last fiscal year (FY16), posting a decline of $ 294.4 million.

Power Sector, Communication and Financial Services — all these sectors are under-performing when compared to results from the FY16 fiscal year.

“Pakistan still ranks the lowest among the ease of doing business index, while energy crisis, higher utility tariff and unavailability of basic infrastructure are major hurdles to foreign investment,” said economists.

In terms of monthly basis, FDI fell by 68 percent during October 2016 compared to October 2015.

With $ 135.5 million inflows and $ 68.7 million outflows, FDI stood at $ 66.8 million in October 2016 against $ 207.1 million in October 2015, showing a decline of $ 140 million.

In recent times, Pakistan has recorded low levels of foreign investment, causing other foreign investors to pull out as well due to persistent energy crisis and sub-par governance. Portfolio investment stands at negative $39.1 million in the four months, mainly due to the profits being leeched by the foreign investors.

Pakistan’s total foreign investment stands at $1.418 billion in first four months of this fiscal year compared to $955.2 million in the corresponding period of last fiscal year. The surge in total foreign investment has been attributed to the issuance of Sukuk Bonds in the global market.

Telecom Sector

Telecom sector received $42.1 million as FDI in the first four months of the current fiscal year as against $140.9 million in the corresponding period of previous year.

Information Technology sector fetched $4.2 million FDI in July-October 2016 compared to -8.4 million in the corresponding period of last fiscal year.

However the overall communications sector (comprising of telecommunication, information technology and postal & courier services) registered -$11.7 million net FDI with $46.4 million inflow and $58 million outflow.

Telecommunication sector registered $42.1 million inflow, $57.8 million outflow and -$15.7 million net FDI during the period under review.

Net FDI in software development remained at $1.8 million and in hardware development it measured at 0.1 million during July-October.

Sukuk Bonds

Sukuk Bonds were recently issued by Pakistan on a five-year basis which have amounted to over one billion dollars in the international market.

The payment of Sukuk Bonds played a key role which is the reason why foreign public investment posted an increase of 137 percent or $ 660.5 million to reach $ 1.142 billion during July-October FY17 compared to $ 481 million foreign public investment in the corresponding period of last fiscal year.

The post FDI Posts 48 Percent Decline This Fiscal Year appeared first on .