FBR Suspends Sales Tax Registration of a Popular Internet Service Provider

Posted by AMBREEN SHABBIR

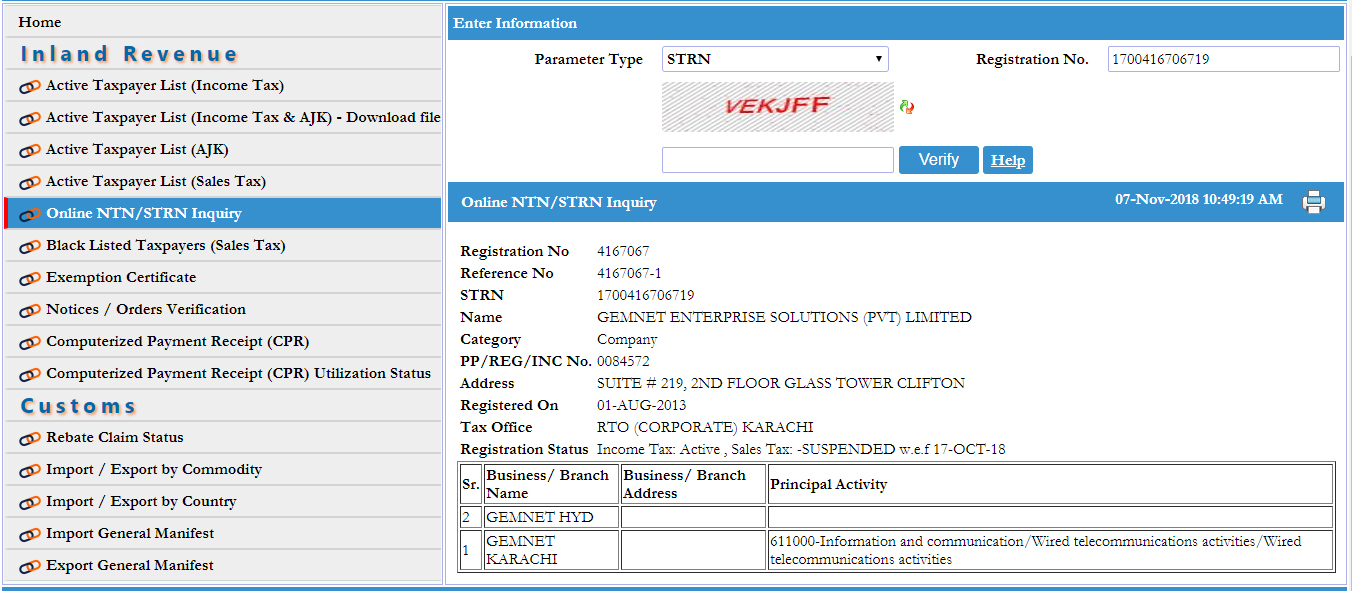

The Federal Board of Revenue (FBR) has suspended the sales tax registration of a prominent internet service provider, Gemnet Enterprise Solutions, after the company refused to furnish its record for audit.

According to a media report, the Corporate Regional Tax Office (CRTO) had selected the company to conduct a tax audit of its records for the period between July 2015-June 2016.

However, the company did not furnish the required documents/records despite having plenty of opportunities for compliance.

The company had also received a notice, issued under section 25 of Sales Tax Act 1990, in this regard. Non-compliance of the notice is a violation of the said Act, which warrants blacklisting or suspension of the business entity.

The issued notice mentioned that if the company fails to comply with the requisites, its sales tax registration will be suspended.

The notice also stated that the provision for suspension without a showcause notice is authenticated by the decision of Sindh High Court in the case of M/s. Sh. Diwan Mohammad Mushtaq vs. Central Board of Revenue (1969).

ALSO READ

FBR Collected Rs 12.2 Billion in Taxes through ATMs, Online Banking Since March

Therefore, the sales tax registration of a leading internet provider service has been suspended and the name of the company has been removed from the Active units list.

Via: Pk Revenue

The post FBR Suspends Sales Tax Registration of a Popular Internet Service Provider appeared first on .