Daily Stock Report: Slow Trading Day as Index Registers 54 Pts Gain

Posted by JEHANGIR NASIR

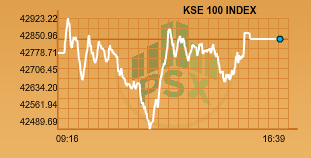

The stock market remained range bound during the whole day. The benchmark index opened positive after a good outgoing week.

The index touched an intraday high of 137 points. After opening positive it didn’t took a while seeing the red zone but closed in green.

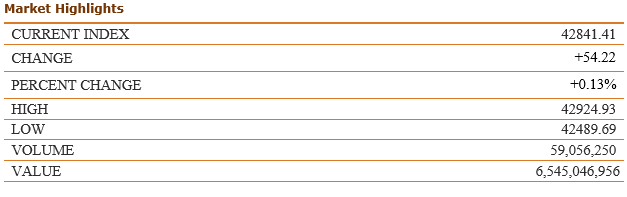

At the end the benchmark index closed with +54.22 or + 0.13% to close at 42841.41 points.

The index tested the day’s high at 42924.93 points .The day’s low of 42489.69 came towards market close.

The PSX shut higher conducted by selected Fertilizer and banking scripts. The KSE-100 index is currently trading at 2018 price-to-earnings multiple of 9 times, compared to average MSCI Emerging Market index forward price-to-earnings of 12 times, indicating a discount of 28.6 times.

According to a big broker, mutual funds are currently sitting on a cash pile of Rs 70 bn, waiting for the stocks to bleed further before entering to buy at cheaper valuations.

Mughal Iron & Steels Industries Ltd and Kohat cement announced Financial Results for the period ended June 30, 2017,

Mughal’s Net Sales for the period decreased by 0.95 percent in the outgoing year, whereas the Profit after Taxation for the Period increased by 11 percent.

The board has recommended a final Cash Dividend for the year ended June 30, 2017 at the rate of 6% i.e. Rs 0.60/- per share. This is in addition to the interim dividend already paid at Rs. 2.00/- per share i.e. 20%.

Whereas Kohat’s Net Sales for the period decreased by 3.42 percent in the outgoing year, whereas the Profit after Taxation for the Period decreased by 20 percent.

The board has recommended a final Cash Dividend for the year ended June 30, 2017 at the rate of 20% i.e. Rs 2.00/- per share. This is in addition to the 1st interim dividend already paid at Rs. 4.00/- per share i.e. 40% and 2nd interim cash dividend already paid at Rs. 8.00/- per share i.e. 80%.

Overall, trading volumes of All share index surged to 113 million shares Overall, stocks of 343 companies were traded on the exchange, of which 128 gained in value, 197 declined and 18 remained unchanged. In KSE 100, 59 million shares were traded with a net worth of Rs 6.5 billion.

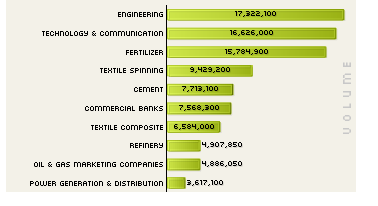

Top traded sectors:

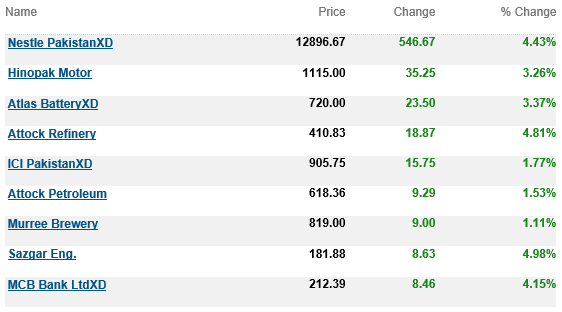

Dost Steel Ltd was the volume leader with 0.80 million shares, gaining Rs 0.48 to close at Rs 12.59. It was followed by TRG Pak Ltd with 8.45 million shares, gaining Rs 1.04 to close at Rs 39.67, Engro Fert with 6.48 million shares, gaining Rs 2.71 to close at Rs 61.01 and , Attock Refinery with 4.30 million shares, gaining Rs 18.87 to close at Rs 410.83.

Top Advancers of the market were:

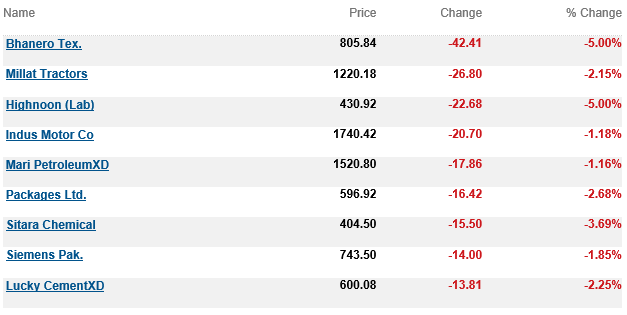

Top Decliners of the market were:

Foreign direct investment in first two months of fiscal year climbed by 155%. It jumped up to 457 million dollars vs 179 million dollars.

Net foreign investment rises 37% to 301 million dollars. Foreign outflow from Stock Market amounts to nearly 150 million dollars. Investment from China amounts to $258 million, USA $202 million and $110 million from Malaysia.

The post Daily Stock Report: Slow Trading Day as Index Registers 54 Pts Gain appeared first on .