Bitcoin Expected to Surge Past $50,000 Within 72 Hours

Posted by AHSAN GARDEZI

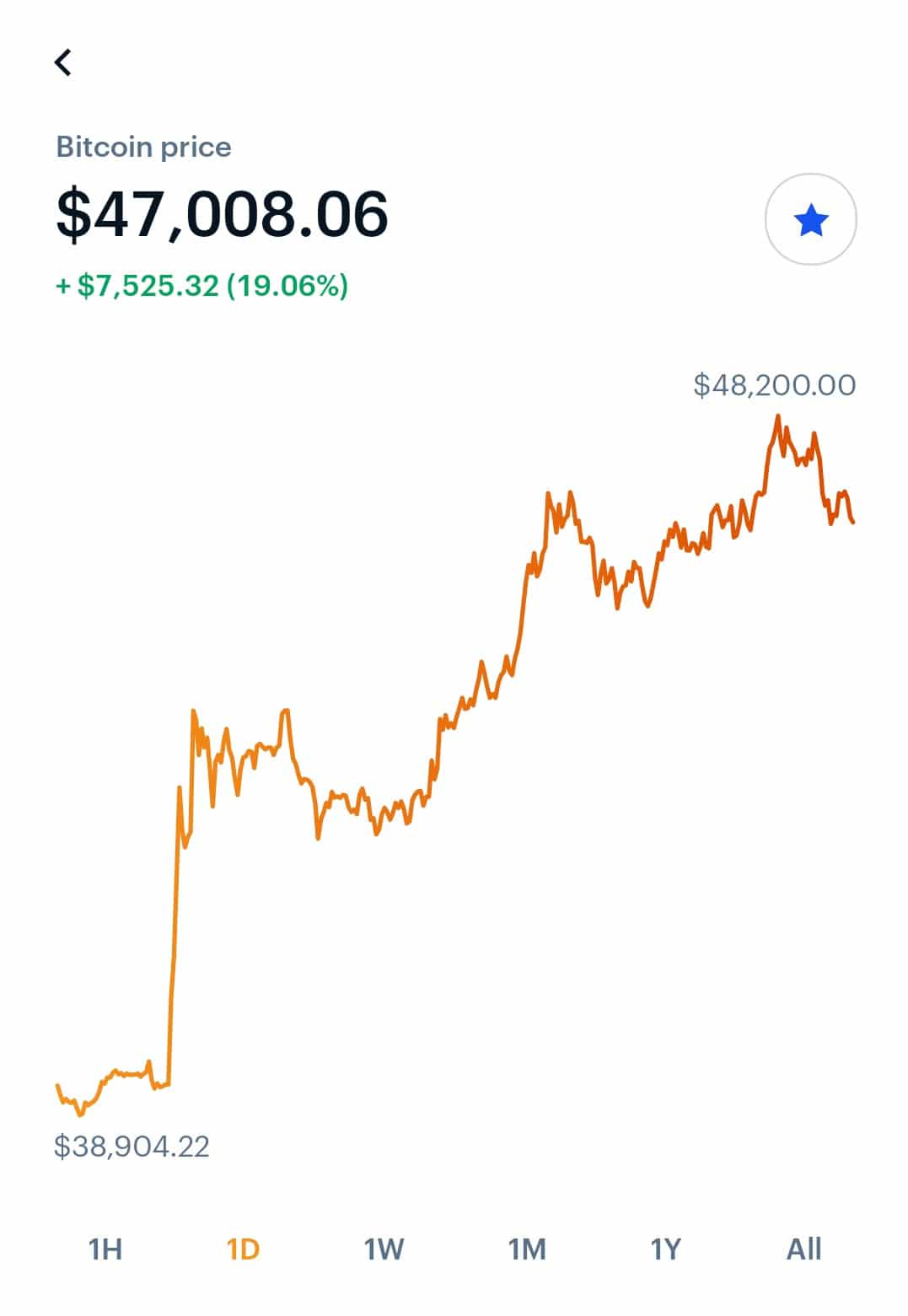

The price of Bitcoin has almost quadrupled from $11,000 to $47,000 following some of the most theatrical power plays by big-money investors during the last three months. All giddy and bullish since the historic financial uptick, big-time crypto investors are speculating that Bitcoin will rise as high as $50,000 within the next three days.

While Bitcoin backdrop continues to compete with gold as an alternative means for storing capital, renowned experts and analysts forecast the digital currency to hit $100,000 by December 2021.

ALSO READ

Apple Should Also Invest in Bitcoin: Wall Street

Bitcoin is currently enjoying a current price north of $46,000, which is more than what it was three months ago.

While this speaks volumes about the amount of growth expected for the digital currency in the next few months, it raises doubts about surviving what experts call ‘the mother of all bubbles’.

So, what exactly is a bubble?

A bubble is when the price of an asset exceeds its inherent value on the back of investment trends and media reports.

When the price peaks at some point, the ‘bubble’ in this case eventually ‘pops’, and the price collapses.

To that effect, crypto projections vary ferociously. While some say that it might reach $60,000 by 2022, others suggest it might even hit $100,000 before 2021 ends. Despite the fluctuations, crypto optimists are confident that “these fluctuations are not going to be enough to slow it down. Bitcoin will likely break $50,000 in 2021”.

Not everyone is sure about the market being in bubble territory, and perhaps this element of uncertainty has fuelled speculations that the “Bitcoin would peak at $115,212 /BTC in August 2021”.

Where is this Trust Coming From?

In contrast to the trends observed in 2017, the reason for the investors’ renewed faith in crypto this year involves the notable firms and tech conglomerates that are doing the investing. In 2017, the price of Bitcoin had peaked because of the individual investors who had believed in the future and value of the digital currency. Back then, Bitcoin was not considered an intelligent investment as it was not backed by either assets or any government due to a lack of mainstream support.

ALSO READ

Xiaomi Announces its Best 4K TV Yet

Since 2020, the rise of Bitcoin is being driven by institutional investments. Companies have continued to drive the bullish cycle, and emerging trends suggest gains for an indefinite period.

#Bitcoin is the world's first engineered safe-haven asset running on the world's first digital monetary network.

— Michael Saylor (@michael_saylor) December 28, 2020

Recently, Square and PayPal added cryptocurrency to their offering. Mainstream financial media is also paying attention to and reporting on crypto around the clock. This time, the attention is not dismissive but is serious business.

The involvement of such large players in the crypto world is giving it the recognition that it needs. This is likely to be the beginning of the entry of digital currency as an emerging norm, and this market seems to be positioned to harden into an impregnable mold in the following years.

The post Bitcoin Expected to Surge Past $50,000 Within 72 Hours appeared first on .